Background

Syn Pitarn Group Holdings (“SPGH”) was founded in 2022 by a team of Thai and Myanmar executives with extensive experience in financial services, based on the belief that all migrant workers in Thailand should have access to the full range of regulated, and transparent, financial services to improve their lives and that of their families back at home.

In 2024 EMIA and Insitor, two leading Asia focused impact funds, invested in SPGH to provide us with capital to expand both our operations and loan book.

The Problem

There are nearly 3 million documented migrant workers and another estimated 2 million illegal workers in Thailand.

All come to seek work attracted by better prospects, higher wages, or just to escape domestic political problems. Thailand, with a rapidly aging society, needs additional workers to maintain its competitiveness.

Most documented workers earn only the minimum wage and have limited access to the range of services provided by financial institutions. Many fall prey to loan sharks that charge up to 20 per cent per month and most workers remit money home through the informal, unlicensed, hundi network.

ESG

SPGH believes that environmental, social and governance (ESG) issues are fundamental to the long-term success of businesses. Therefore we are committed to managing our business responsibly by integrating ESG considerations into our processes.

We believe that doing business sustainably drives positive development outcomes and ultimately improves the lives of all our stakeholders and the long-term competitiveness of the company.

In addition to our own efforts, we will be working with other development partners to deliver a series of support programs designed to create sustainable value for our clients and to the Myanmar diaspora community in Thailand.

Our services aim to improve the lives of our clients and their families back home and help contribute to the following SDGs.

![]()

Our investors

In addition to the experienced management team that founded the business, Syn Pitarn is backed by two well known institutional impact investors.

EMIA

Established in 2009, EMIA is a Singapore-registered private equity fund manager committed to building innovative, transparent and sustainable businesses in Southeast Asia. EMIA seeks investment opportunities to achieve attractive returns and to create inclusive, sustainable growth, having invested in 23 companies across a variety of sectors in ASEAN’s Frontier markets that promote its broader investment strategy.

www.emergingmarkets.asia/investments

Insitor

Insitor is an impact investment fund backing companies that build life-changing solutions for low-income consumers across South and Southeast Asia. Insitor focuses on investments in early stage companies in emerging industries, and is dedicated to supporting these businesses with the dual objective of maximizing financial returns and creating a positive social impact. Focus sectors of the fund include agriculture, financial services, water and sanitation, affordable housing, healthcare, and education. Since its founding in 2009, Insitor has invested in 33 portfolio companies that have positively affected the lives of more than 54 million low-income consumers.

www.insitorpartners.com

Syn Pitarn

SPGH’s objective is not only to provide clients with excellent and useful services but in time to provide digital and financial literacy education.

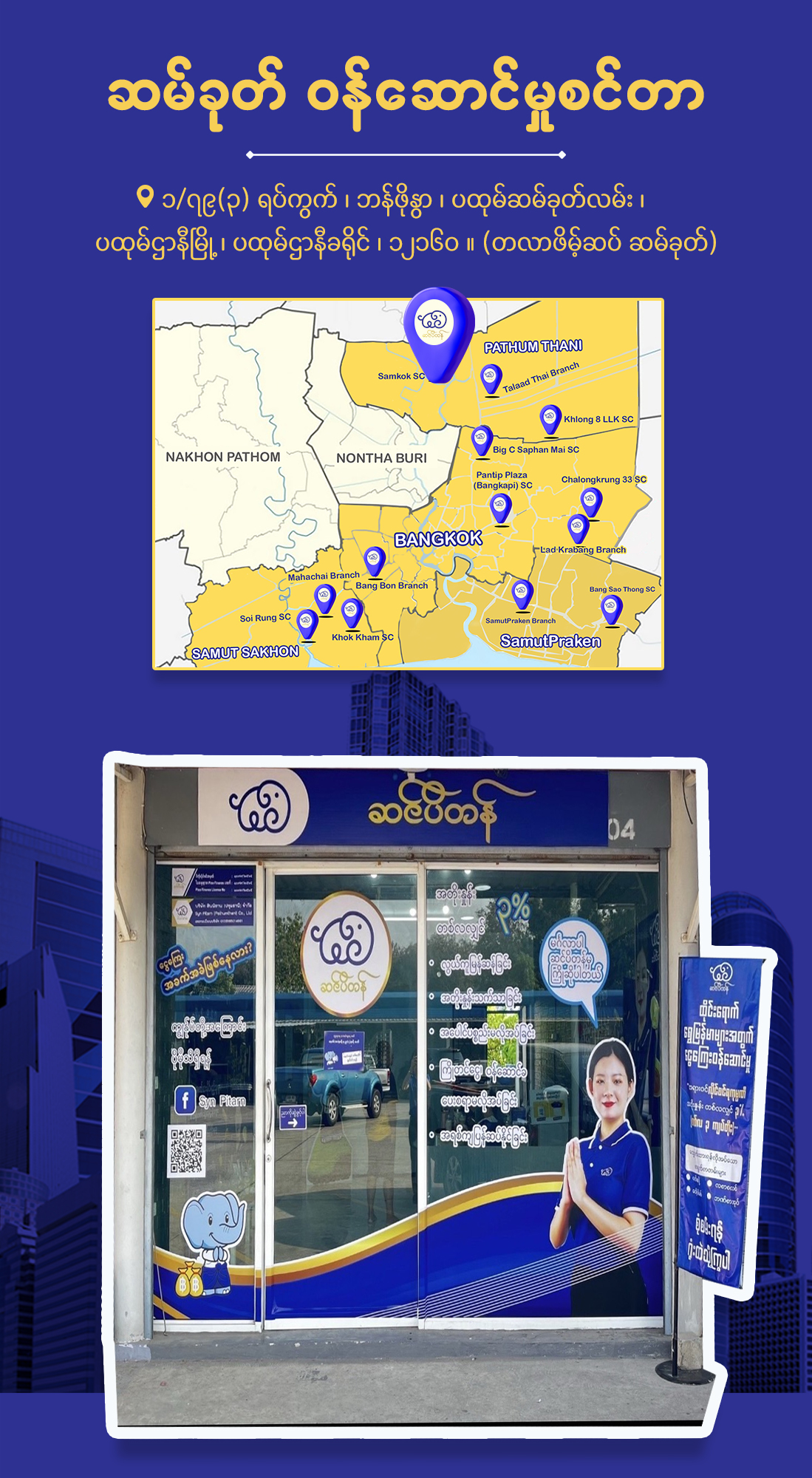

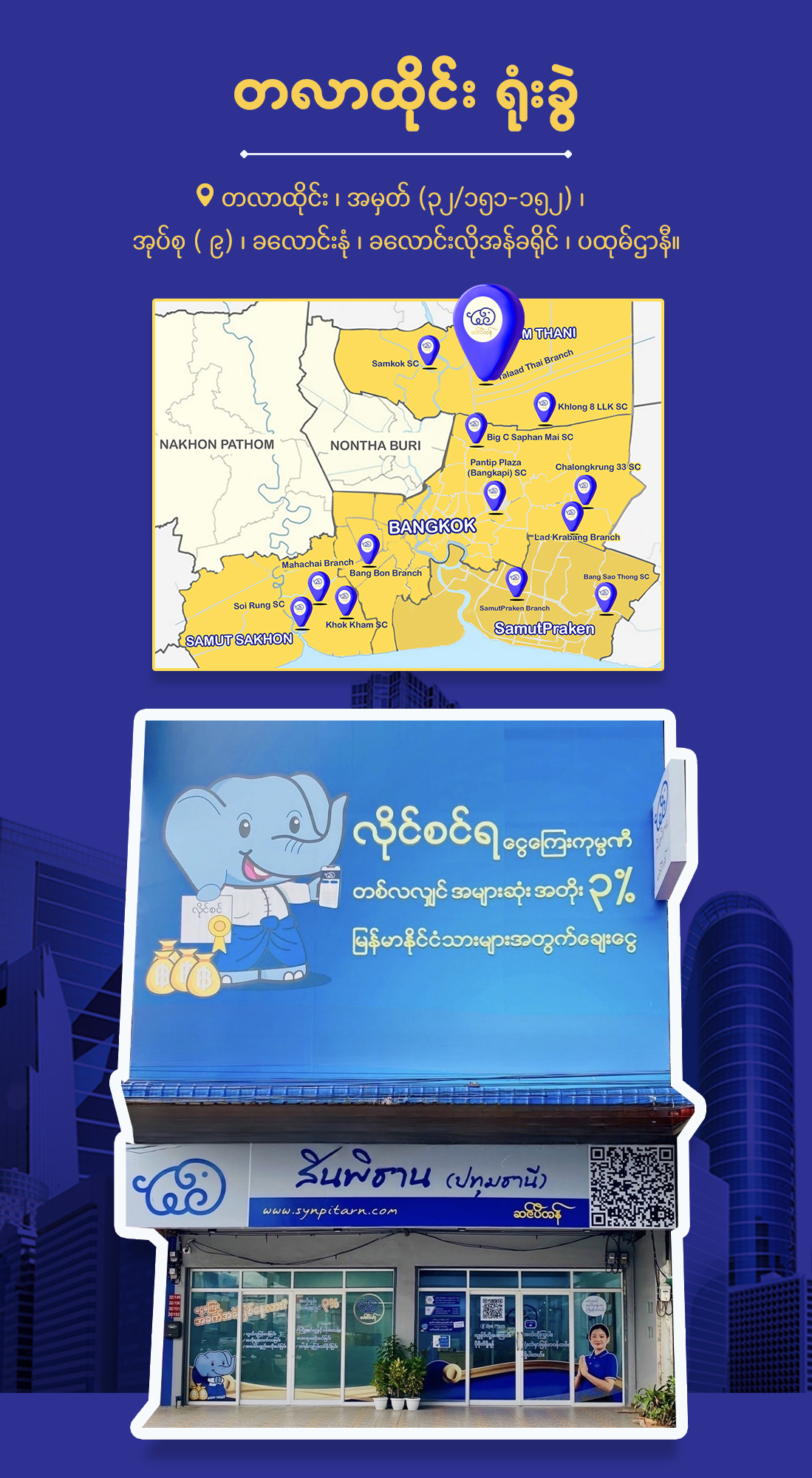

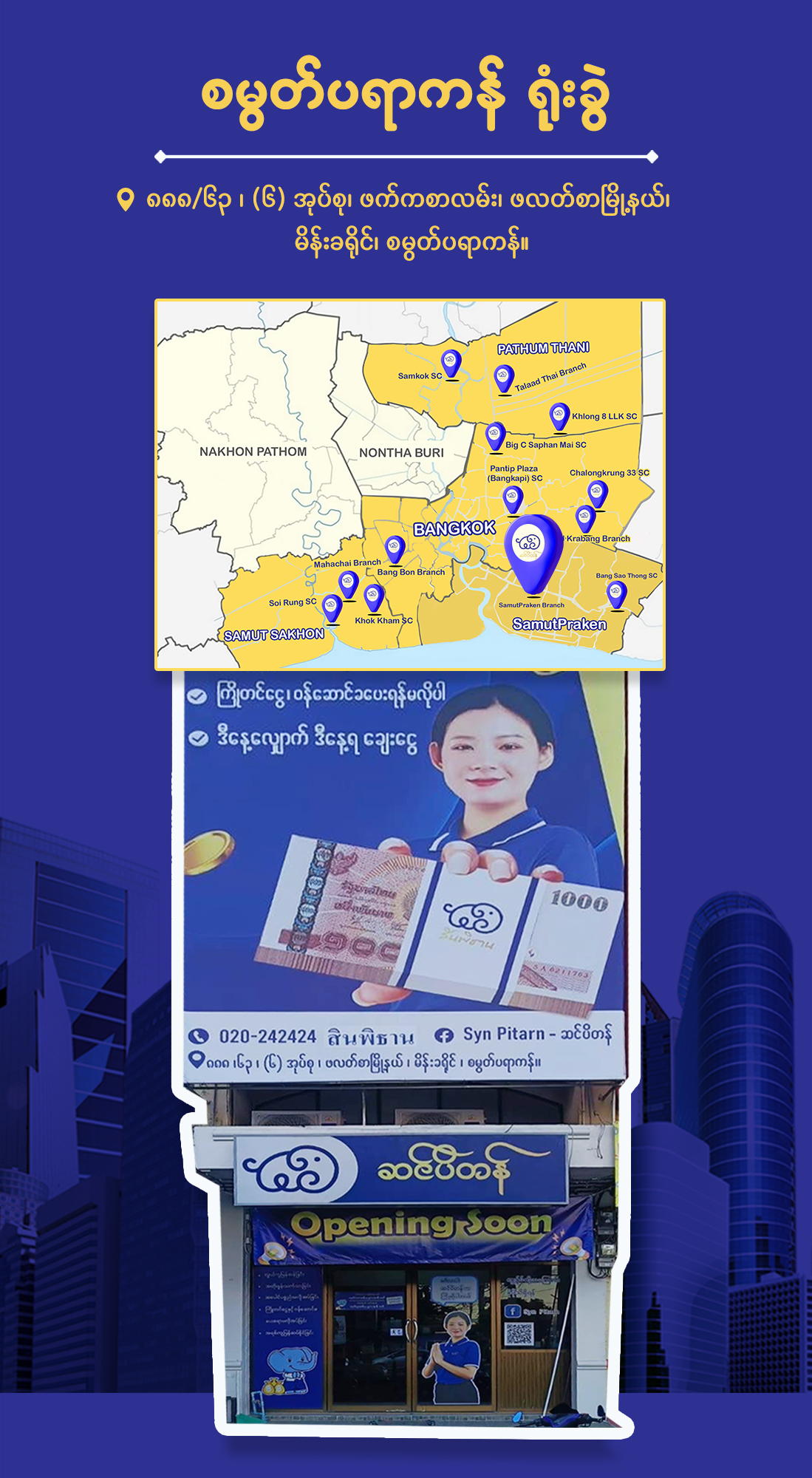

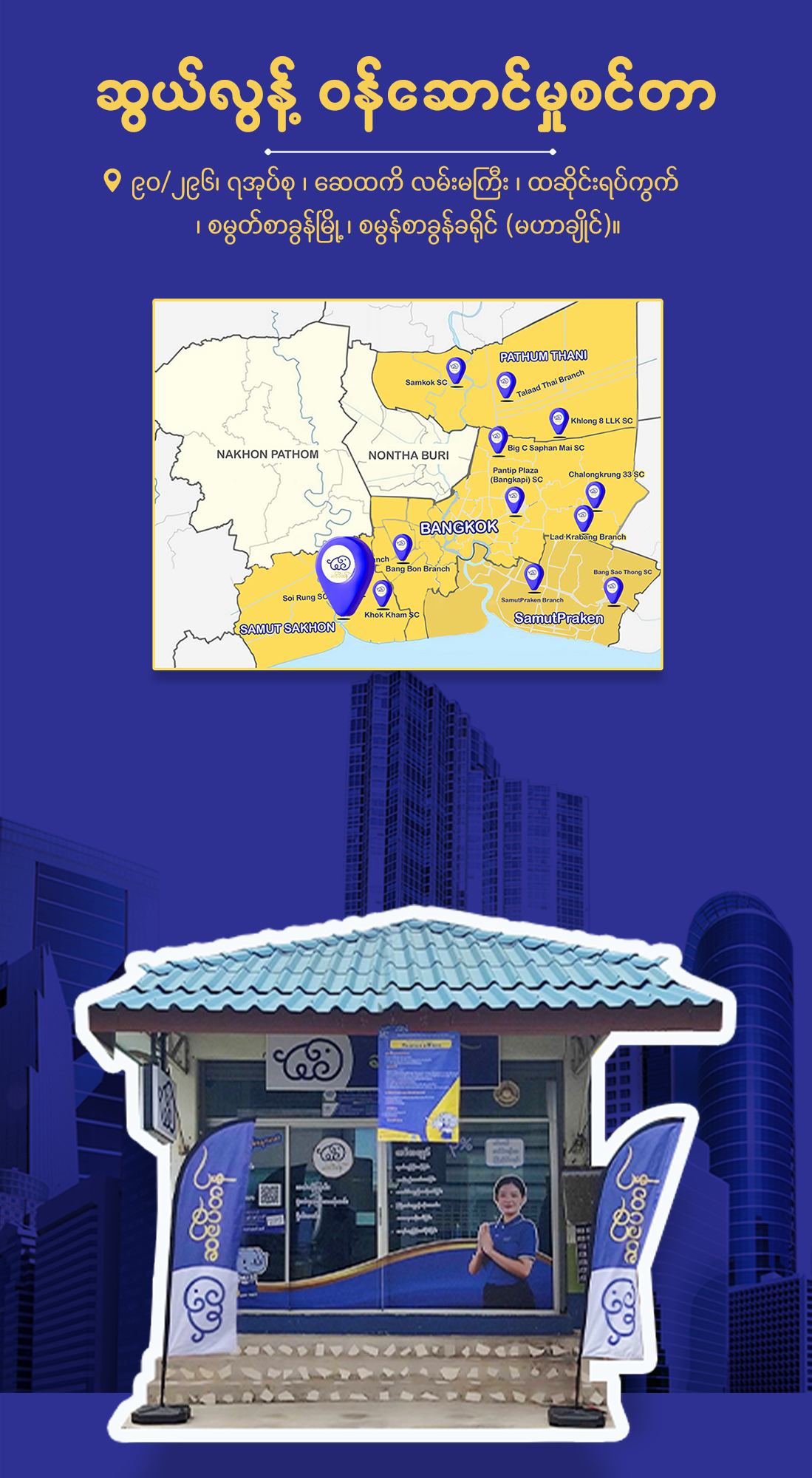

Potential clients can learn more about our services in Myanmar language on our lending website www.synpitarn.com or on our Facebook page and can apply for a loan either online on their mobile phone or visit our growing number of branches and service centres.

Our loan officers are trained to explain our products and guide applicants through the application process. Applicants will always have access to a Myanmar speaking officer.